Delivering on Best Execution compliance obligations is a data management challenge – and one that many firms are struggling with. As a result of the data obstacles financial firms face, they often take a constricted view of how they can measure their executions, and the kind of analysis they can employ to meet the demands of the applicable rules. However, by taking a more data-centric approach to meeting compliance challenges, firms can improve how they approach their Best Execution obligations. They can also enhance how they use their data to a) detect potential Best Execution policy breaches more quickly, and b) improve their analytics to drive better business decisions.

By not addressing their Best Execution data management challenges head-on, many firms will find themselves unable to benefit from the value-generating insights that a robust data set and strong analytics can deliver. As a result, compliance with Best Execution rules, such as the EU’s Markets in Financial Instruments Directive II (MiFID II), will remain a sunk cost rather than an opportunity to improve business efficiency and enhance performance.

This blog explores some of the key questions around Best Execution data management that firms should be asking themselves as they seek to improve their compliance processes.

Topics covered in this blog:

Best Execution Data Management Challenges

What are the best execution data management challenges that financial services firms face today?

There are three major data management challenges that firms should address:

-

Data volumes

Properly analysing trades for Best Execution and performing Best Execution investigations on potentially problematic trades requires large quantities of both structured and unstructured data. For example, transaction cost analysis (TCA) uses market pricing and reference data to enable trading and compliance teams to determine if a trade achieved Best Execution.

-

Data cleaning and normalisation

.webp?width=350&name=Best%20Practices%20for%20Best%20Execution%20Data%20Management%20SteelEye-min%20(1).webp) While it is straight-forward to acquire market and reference data, data from different sources requires cleaning, consolidating and normalisation. Bringing a wealth of data together in one place is challenging, which is why many Best Execution programmes operate on a decentralised basis in different regions. For example, trading desks in specific geographies may use different market data and reference data sources, which other teams may not have access to.

While it is straight-forward to acquire market and reference data, data from different sources requires cleaning, consolidating and normalisation. Bringing a wealth of data together in one place is challenging, which is why many Best Execution programmes operate on a decentralised basis in different regions. For example, trading desks in specific geographies may use different market data and reference data sources, which other teams may not have access to.

-

Managing other data types

To evaluate Best Execution, other information is required including timestamping data such as when an investment manager takes a decision and when the trader sends the order to various brokers or dealers in potentially different markets. For investigations, a compliance team may also need to find voice and electronic communications related to the transaction. In these instances, it can be difficult to identify the right records and align this with the trade data.

Collecting, cleaning and normalising data manually is a very challenging task. As a result, some firms just sample transactions from across their business to fulfil their Best Execution requirements. This is a resource-intensive approach that can lead to a time lag between when the trade is conducted and when an alert is flagged as being in breach of the firm’s Best Execution policies. Also, by not centralising all the data in one place, the manual approach cannot drive analytics that will provide intelligence to compliance teams and the business about the strength of their execution.

TCA is not Always enough

While TCA has become a useful tool for compliance with regulations such as MiFID II and Dodd-Frank, it does not reflect all the factors involved in understanding if a trade has achieved Best Execution – it focuses on price alone. Most order execution policies (OEPs) seek to apply a wider range of factors to determining Best Execution, such as the fees charged by the broker or dealer to execute the trade and the efficiency of the technology systems used to conduct the trade.

To truly understand if a trade achieved Best Execution, these other factors need to be analysed in addition to price, so that a more holistic picture of Best Execution can be created.

Best execution data management best practices

Financial services firms should automate the data management they need to fulfil Best Execution compliance obligations and centralise all their Best Execution data on a single platform. This includes automating the collection and storage of all required data in a single location, as well as the data cleaning and normalisation.

This kind of automation can reduce the costs associated with managing, analysing, and reporting on the data. It will also reduce compliance risks associated with failing to catch a breach of Best Execution policies, and operational risks that emerge with mistakes in manual data processes.

What are some best practices for investigations and case management?

Best Execution investigations can occur when a trade, through analysis, is flagged up as having fallen outside the firm’s OEP. They can also happen when a regulator expresses concerns about a trade, or when a customer complains about the way a trade has been handled.

Having a single golden source of data that is already cleaned and normalised can speed up Best Execution investigations. Investigation time can be spent actually analysing data to better understand what led up to an execution decision, rather than engaging in manual data management. When Best Execution investigations are happening under time pressure – being able to focus on the important issues in a timely manner is essential.

Automating Best Execution data management processes and storing the data in a single location also enables the adoption of case management workflow tools. By having a case management system that is connected directly to the data and related communications, investigations can move forward quickly and easily, with all those involved having immediate access to the information they need to perform their role in the process. It also enables the actions and information that investigations generate to be captured and to be auditable.

|

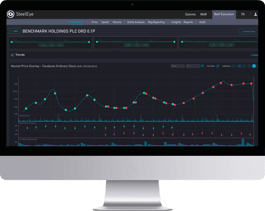

Meet your Best Execution requirements SteelEye's Best Execution Solution

|

How can best execution regulatory reporting be automated?

Having all of the data in one place, under the aegis of one set of workflows, means that firms are then able to automate Best Execution reporting. Under the EU’s MiFID II, required Best Execution reports include:

-

Assessments of the execution quality obtained on different execution venues (RTS 27)[1]

-

The top 5 execution venues by volume, broken down by instrument class (RTS 28) [2]

-

Execution venues must publish a quarterly summary of the quality of their execution

While the data firms are required to report is straight-forward, it can often be stored in many different systems across the business, making manual data management time-intensive and expensive for compliance teams. The manual approach is potentially also open to error and the resulting compliance risk from mis-reporting.

On the other hand, if quarterly RTS 27 and annual RTS 28 reports are automated, the required fields are populated and can be reviewed, downloaded and published effortlessly.

[1] This report has been temporarily suspended by the UK Financial Conduct Authority for UK firms.

[2] This report has also been temporarily suspended by the UK Financial Conduct Authority for UK firms.

Using best execution data for decision making

How can best execution data be transformed into value-driving business analytics?

Today many firms are recognising that by employing data management best practices for Best Execution – including automation – they are able to gain additional benefits for the business. Firms are applying a range of analytical tools and benchmarking metrics to their Best Execution data to help them assess the true cost of trading. For example, buy-side firms can use business-focused analytics to improve their broker reviews – to better understand the relationship between fees and execution performance.

By having a robust data set, firms can also look at investment and alert patterns. For example, there has been an acceleration towards alerting not just for risk management but to optimise executions. Broader use of alerting is being used to better manage orders and access liquidity - where firms are focussing on getting smarter around how they trade by leveraging and getting answers from their data.

Looking ahead - Getting Best Execution Data Management Right

Many firms are still grappling with range of Best Execution data management challenges and those that are trying to tackle these issues with manual processes are potentially missing Best Execution policy breaches and the opportunity to use their data for enhanced insight.

However, by taking a data-centric approach and applying automation to data management, analysis and reporting for Best Execution can deliver significant benefits, such as:

-

Faster detection of potential Best Execution policy breaches

-

More efficient Best Execution investigations, informed by data

-

Automation of regulatory reporting

-

Lower data management costs

-

Reduced compliance and operational risk around Best Execution

-

Improved analytics to help drive better business decisions

Best Execution, But Better

Best Execution, But Better

SteelEye’s comprehensive and asset class agnostic Best Execution solution enables firms to effortlessly meet their reporting requirements and carry out TCA to improve their trading performance.

Book a demo | Learn more >

.webp?width=350&name=Best%20Practices%20for%20Best%20Execution%20Data%20Management%20SteelEye-min%20(1).webp) While it is straight-forward to acquire market and reference data, data from different sources requires cleaning, consolidating and normalisation. Bringing a wealth of data together in one place is challenging, which is why many Best Execution programmes operate on a decentralised basis in different regions. For example, trading desks in specific geographies may use different market data and reference data sources, which other teams may not have access to.

While it is straight-forward to acquire market and reference data, data from different sources requires cleaning, consolidating and normalisation. Bringing a wealth of data together in one place is challenging, which is why many Best Execution programmes operate on a decentralised basis in different regions. For example, trading desks in specific geographies may use different market data and reference data sources, which other teams may not have access to.