Compliance teams are having a torrid time of it. Regulatory change is happening in such volume and so quickly that teams can be excused for feeling as though they are being asked to run a marathon at the speed of a sprint.

There are too many projects, a scarcity of resources, and key issues that seem unsolvable. And this was before Covid-19 hit the financial services sector, adding to the challenges of compliant home working and pulling together required data when processes are manual and information spread across a wide array of platforms and systems.

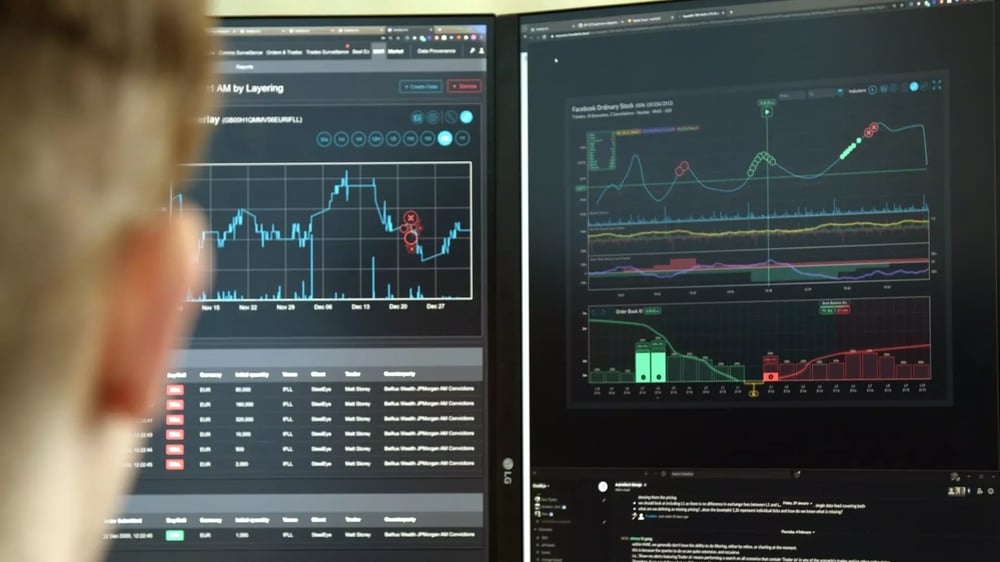

This guide explores key challenges around compliance, risk and regulatory change that are impacting how financial services are approaching compliance requirements such as regulatory reporting, best execution and market abuse surveillance. It then considers a fresh approach to data governance & compliance for financial institutions based on understanding what lies at the core of these issues, and suggests ways in which digital transformation, with its focus on data quality, has a role to play in improving financial services compliance and risk.

It is clear that the way that financial firms are approaching the compliance challenges created by regulatory change is not working, and that a new approach is needed. Moreover, tackling the issues created by regulatory change through digital transformation opens possibilities for regulatory compliance in financial services to deliver value to the business in new ways.