About the webinar

In the last 12 months, the regulatory reporting landscape has become increasingly complex. A number of vendors have closed their reporting businesses and we have also seen reporting changes on the back of Brexit.

Looking ahead, ESMA recently announced a proposed set of amendments to MIFIR transaction and reference data reporting regimes and there are a range of other upcoming changes, including the EMIR Refit and further anticipated divergence between the UK and EU.

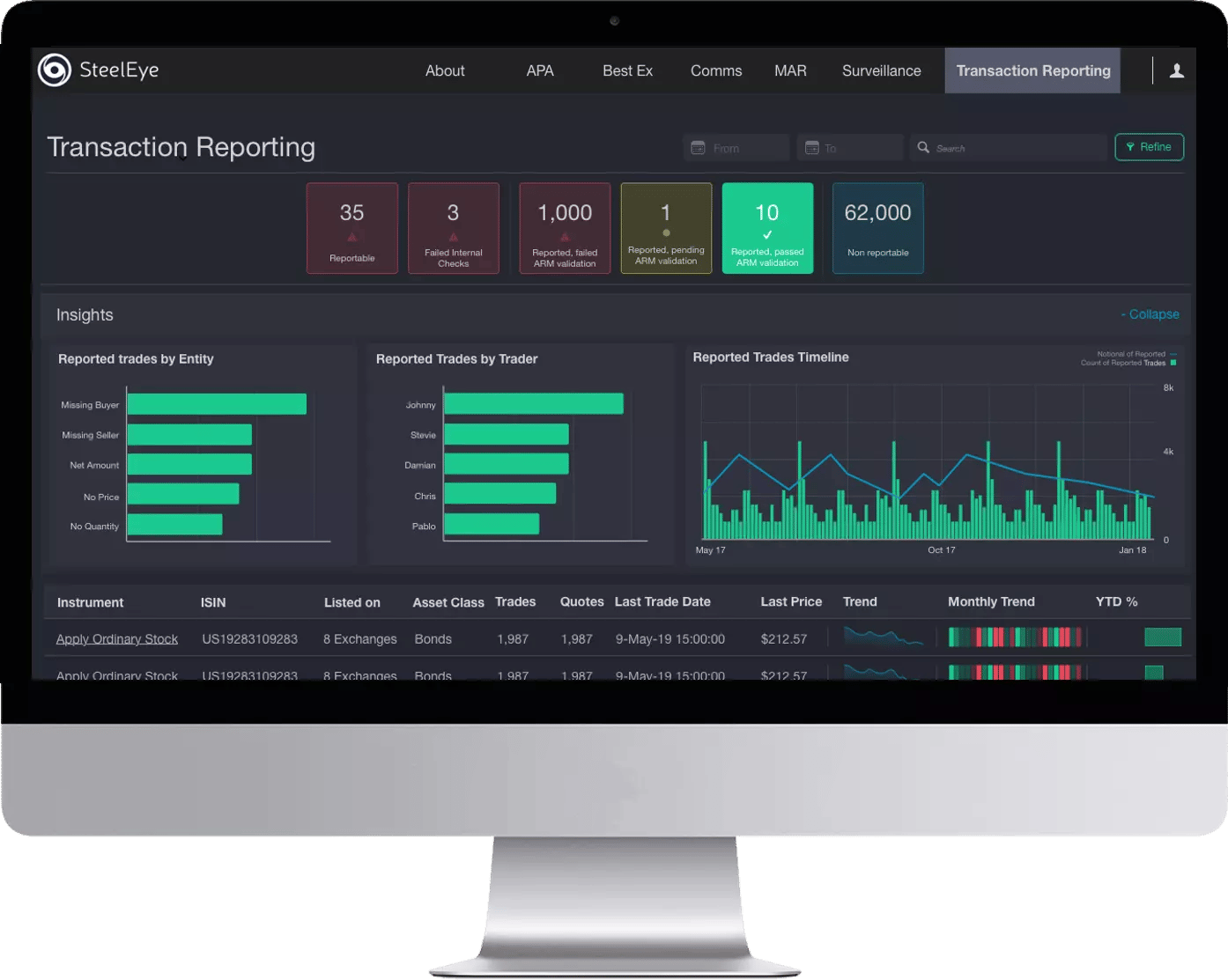

At the same time, financial firms are facing increased scrutiny from regulators when it comes to reporting data quality. Prior to Covid-19, regulators were signalling that their patience had worn thin around reporting errors and firms can expect focus to return to this issue in 2021 and beyond. Yet many firms still struggle with ensuring their data is complete and accurate, impacting their ability to report in a timely manner.

At a fundamental level, meeting reporting requirements and managing regulatory change is about getting the data right.

This webinar looks at how past and future changes are shaping the reporting market and what firms should be doing to improve their reporting in the long term.

.webp?width=450&name=SteelEye%20webinar%20-%20The%20future%20of%20regulatory%20reporting%20-%20Watch%20on-demand%20(1).webp)

Matt Smith

Matt Smith Dario Crispini

Dario Crispini