Commodity trading firms are required to comply with a wide range of regulatory obligations, from record keeping and communications monitoring, to trade surveillance and reporting.

With scrutiny of non-compliance higher than ever, firms must have watertight compliance processes for meeting these rules.

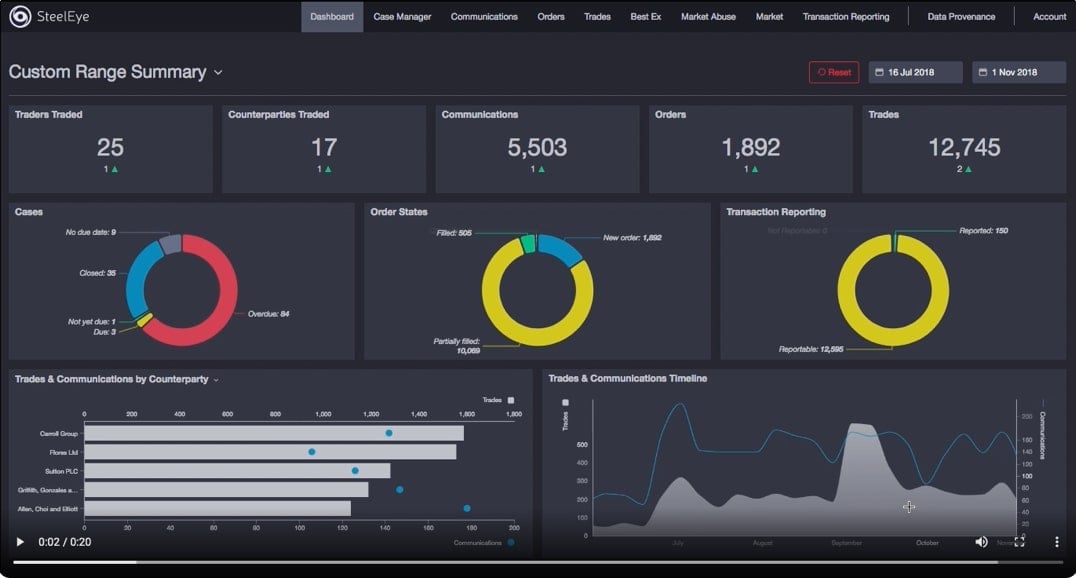

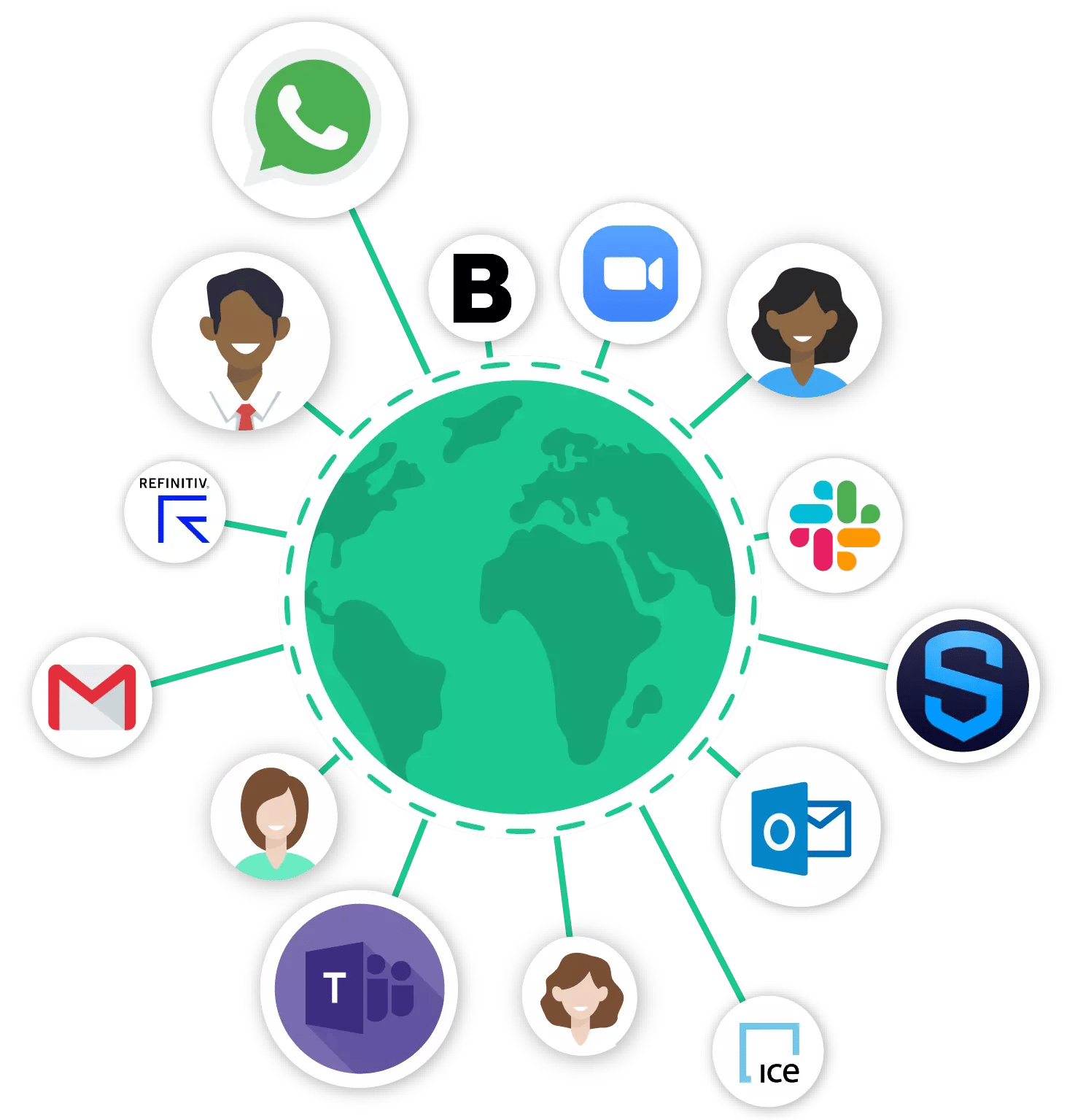

SteelEye’s market-leading compliance technology consolidates your data, simplifies compliance, and future-proofs your firm for regulatory change. Data is stored in an immutable, internationally compliant format - in line with CFTC, FINRA, IIROC, MiFID II, MAR, SEC rules - for robust record keeping. The platform provides advanced tools to ensure that your regulatory reporting, communications oversight, and trade surveillance exceed regulatory standards.

.webp)

.webp?width=180&height=117&name=HFM%20European%20Services%20Awards%202024%20(3).webp)

.webp?width=135&height=135&name=SteelEye-Best-Market-Surveillance-Provider-2023%20(1).webp)

.webp?width=180&height=116&name=HFM-European-Services-Awards-2022%20(1).webp)

.webp?width=225&height=75&name=RegTech-Insight-Awards-22%20(1).webp)

.png?width=180&height=66&name=Risk%20Awards%202021%20SteelEye%20(3).png)

.webp?width=180&height=60&name=Best%20buy%20side%20market%20surveillance%20tool%20platform%20(2).webp)