Your regulatory obligations simplified.

Not only have regulatory requirements become onerous, they are constantly growing, and each piece of legislation is large and complex. This has increased the pressure on the compliance function - driving up costs and the demand for skilled staff.

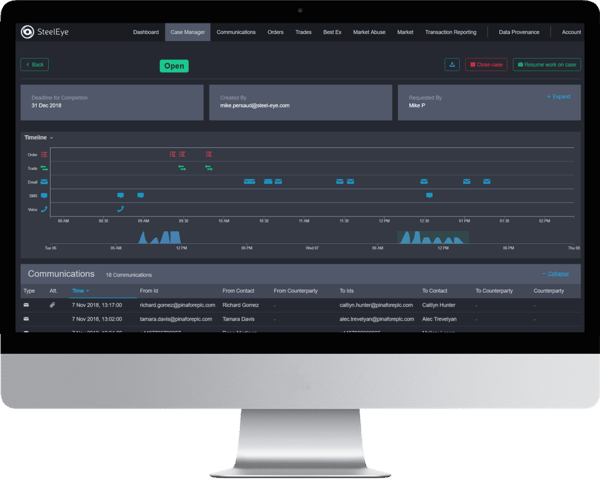

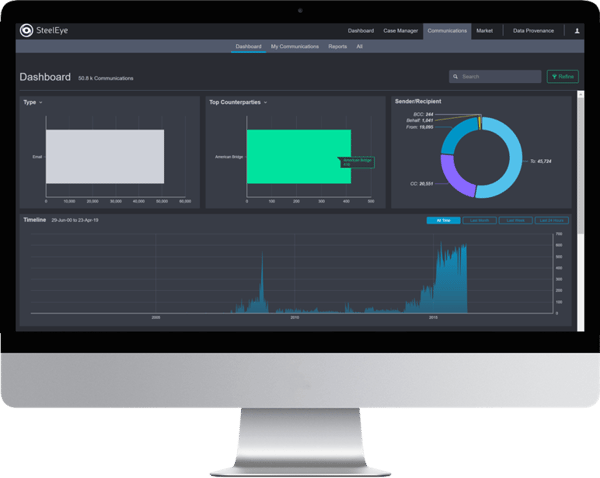

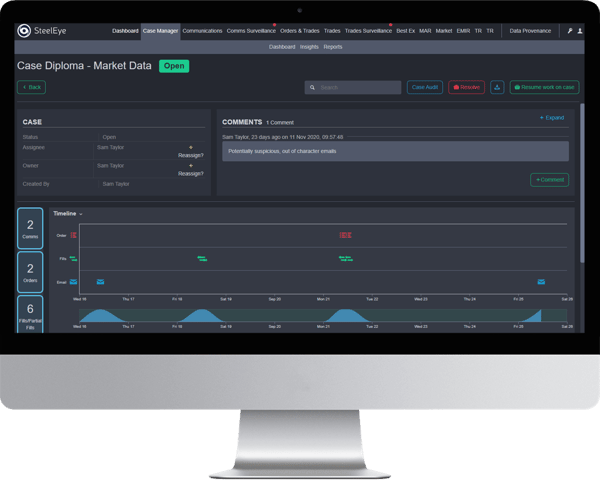

SteelEye enables you to effortlessly bring together your structured and unstructured data from disparate systems, store that data in an immutable and tamper-proof Write Once, Read Many (WORM) format in line with global obligations, and leverage it for simplified and cost-effective compliance with FINRA, MAR, MiFID II, SEC rules and more.

.webp?width=901&name=SteelEye%20Voice%20Transcription%20(1).webp)