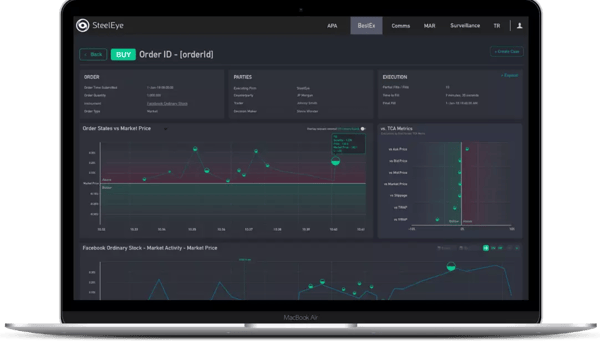

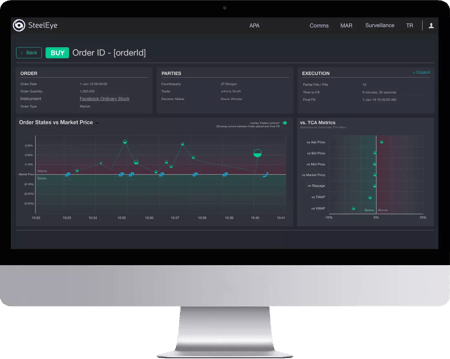

Measure your trading performance and meet your regulatory requirements for Best Execution

The ability to demonstrate execution performance has grown in importance over recent years. Regulations like MiFID II have introduced increasingly strict Best Execution rules, requiring firms to provide evidence that they are acting in their client's best interests on all trades. However, gathering, benchmarking, and reporting on execution data has become increasingly time-consuming and complex due to the vast number of trading platforms firms today use, in addition to the wide range of instruments and asset classes they trade.