Stricter rules require asset management compliance and data management processes to be watertight to avoid sanctions or reputational damage.

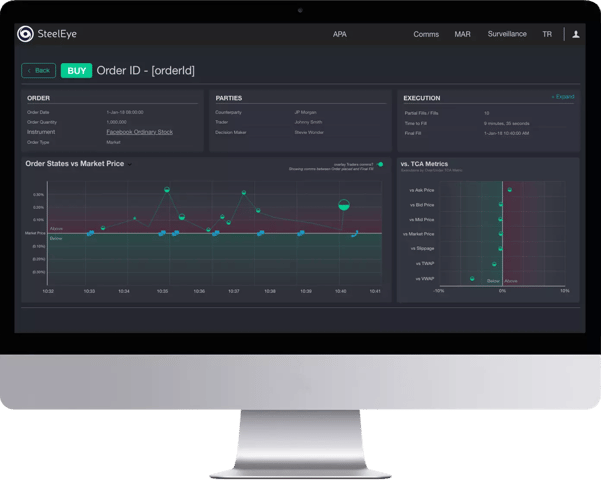

SteelEye’s cutting-edge RegTech platform consolidates your data and simplifies your transaction reporting, communications oversight, and trade surveillance – enabling you to effortlessly satisfy regulatory compliance obligations. Data is stored in an immutable, internationally compliant format (in line with CFTC, FINRA, IIROC, MiFID II, MAR, SEC rules, and more) for robust record-keeping and eDiscovery. Qualitative validation ensures your reporting, oversight, and risk detection meet regulatory standards.

.webp)

.webp)

.webp?width=180&height=117&name=HFM%20European%20Services%20Awards%202024%20(3).webp)

.webp?width=135&height=135&name=SteelEye-Best-Market-Surveillance-Provider-2023%20(1).webp)

.webp?width=180&height=116&name=HFM-European-Services-Awards-2022%20(1).webp)

.webp?width=225&height=75&name=RegTech-Insight-Awards-22%20(1).webp)

.png?width=180&height=66&name=Risk%20Awards%202021%20SteelEye%20(3).png)

.webp?width=180&height=60&name=Best%20buy%20side%20market%20surveillance%20tool%20platform%20(2).webp)