Trade Surveillance

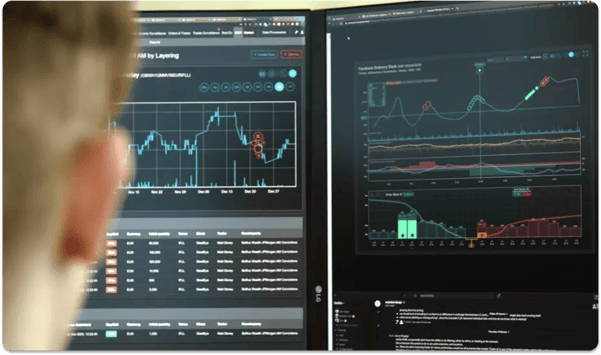

Firms need to proactively carry out trading analytics and forensic testing to identify suspicious activity and market abuse. SteelEye's asset class agnostic Trade Surveillance solution offers comprehensive coverage for a wide range of market abuse activities and behaviors, enabling you to strengthen your supervisory oversight, improve your risk detection, and continuously demonstrate compliance.

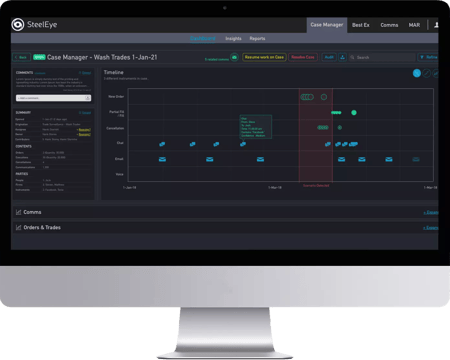

.webp?width=450&name=SteelEye-Trade-Surveillance-Software%20(2).webp)