Improving compliance is a top priority for hedge funds in order to satisfy evolving regulatory demands. However, given the complexities involved and the implications of compliance breaches, your transaction reporting, surveillance, and data management processes need to be watertight.

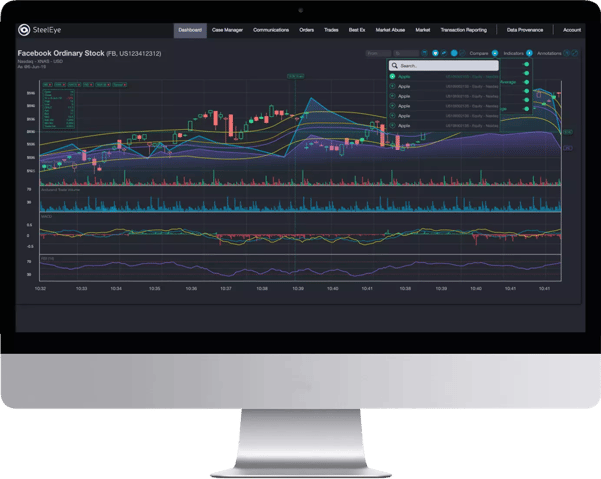

SteelEye’s cutting-edge Hedge Fund Compliance Solutions, powered by automation, consolidate your data from multiple sources and simplify hedge fund compliance - future-proofing your firm for regulatory change. Data is stored in an immutable, internationally compliant format (in line with CFTC, FINRA, IIROC, MiFID II, MAR, SEC rules, and more) for robust record-keeping and eDiscovery. Qualitative validation ensures your reporting, oversight, and risk detection meet the regulatory standards.

.webp)

.webp)

.webp?width=180&height=117&name=HFM%20European%20Services%20Awards%202024%20(3).webp)

.webp?width=135&height=135&name=SteelEye-Best-Market-Surveillance-Provider-2023%20(1).webp)

.webp?width=180&height=116&name=HFM-European-Services-Awards-2022%20(1).webp)

.webp?width=225&height=75&name=RegTech-Insight-Awards-22%20(1).webp)

.png?width=180&height=66&name=Risk%20Awards%202021%20SteelEye%20(3).png)

.webp?width=180&height=60&name=Best%20buy%20side%20market%20surveillance%20tool%20platform%20(2).webp)