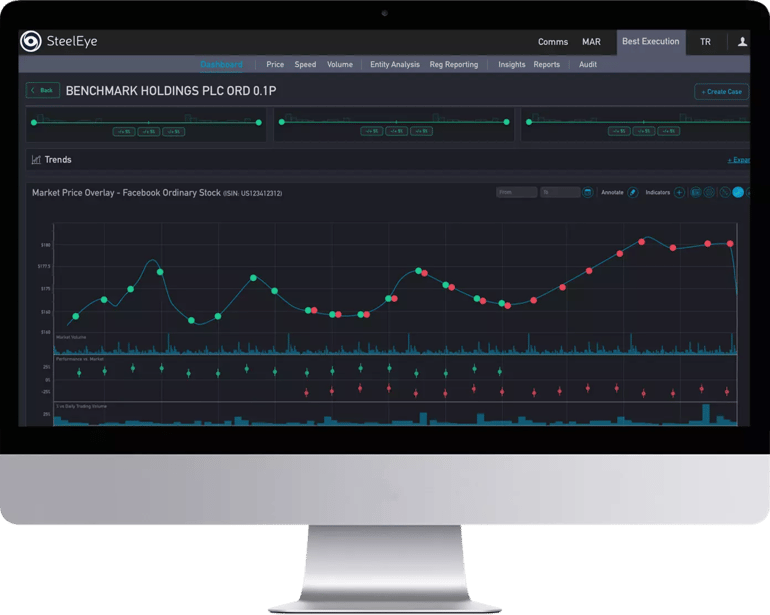

Stricter compliance rules are putting increased pressure on broker-dealers. With scrutiny of non-compliance higher than ever, your transaction reporting and data management processes need to be watertight, while your oversight and surveillance capabilities must be comprehensive.

SteelEye’s cutting-edge RegTech software, powered by automation, consolidates your data, simplifies broker-dealer compliance, and future-proofs your firm for regulatory change. Data is stored in an immutable, internationally compliant format (in line with CFTC, FINRA, IIROC, MiFID II, MAR, SEC rules, and more) for robust record-keeping and eDiscovery. Qualitative validation ensures your regulatory reporting, communications oversight, and trade surveillance meet regulatory standards.

.webp?width=180&height=117&name=HFM%20European%20Services%20Awards%202024%20(3).webp)

.webp?width=135&height=135&name=SteelEye-Best-Market-Surveillance-Provider-2023%20(1).webp)

.webp?width=180&height=116&name=HFM-European-Services-Awards-2022%20(1).webp)

.webp?width=225&height=75&name=RegTech-Insight-Awards-22%20(1).webp)

.png?width=180&height=66&name=Risk%20Awards%202021%20SteelEye%20(3).png)

.webp?width=180&height=60&name=Best%20buy%20side%20market%20surveillance%20tool%20platform%20(2).webp)