The need for

Integrated Surveillance

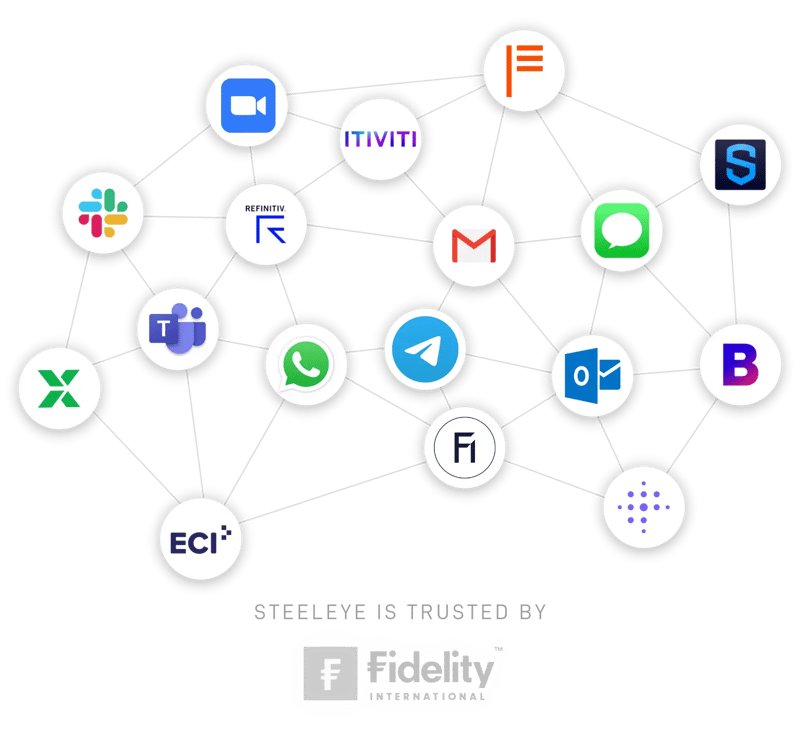

Monitoring the wide variety and high volume of communications across ever-expanding collaboration channels is complex and costly. At the same time, increasing trade surveillance regulations and regulatory scrutiny add operational overhead and risk.

Compounding these challenges is the fact that communications and trade surveillance systems aren’t aligned, which creates awkward workflows, inefficient processes, and high false positive rates. Siloed data limits oversight, often resulting in missed signals of risk, while disparate systems and processes make it hard to carry out investigations and onboard new tools and channels.