The threat of reputational damage and penalties for non-compliance is a growing concern for financial institutions. Your bank’s regulatory processes need to be watertight – which is increasingly difficult considering the scale and range of data sources and channels involved.

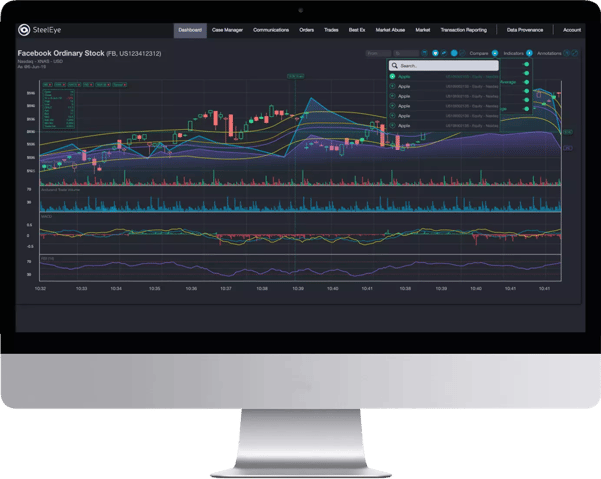

SteelEye’s bank compliance solutions, powered by automation, consolidate your data and simplify transaction reporting, communications oversight, and trade surveillance - future-proofing banks for regulatory change. Our banking compliance platform stores data in an immutable, internationally compliant format (in line with CFTC, FINRA, IIROC, MiFID II, MAR, SEC rules, and more) for robust record-keeping and eDiscovery. Qualitative validation ensures your reporting, oversight, and risk detection meet regulatory standards.

.webp?width=180&height=117&name=HFM%20European%20Services%20Awards%202024%20(3).webp)

.webp?width=135&height=135&name=SteelEye-Best-Market-Surveillance-Provider-2023%20(1).webp)

.webp?width=180&height=116&name=HFM-European-Services-Awards-2022%20(1).webp)

.webp?width=225&height=75&name=RegTech-Insight-Awards-22%20(1).webp)

.png?width=180&height=66&name=Risk%20Awards%202021%20SteelEye%20(3).png)

.webp?width=180&height=60&name=Best%20buy%20side%20market%20surveillance%20tool%20platform%20(2).webp)