2021 is shaping up to be a pivotal one for the way financial services firms engage with data to enhance their decision making. A wide range of pre-existing trends – such as increased cloud adoption, flexible working, compliance automation and data governance – have been amplified and accelerated by Covid-19 and related events. Lockdowns have highlighted the lack of operational resilience in manual processes; the problems with scattered and ungoverned data; and the weaknesses of technology that is operated on-premise. At a fundamental level, the pandemic is changing the way firms and their regulators approach data and technology.

The ability to access and use one’s data is not only vital for operational resilience, but now one of the most important drivers for a competitive advantage.

Now, new priorities are emerging around how firms should harvest, process, store and use data, both at the operational level and the strategic level. Business leaders know that data sitting in silos or spread across different platforms is difficult to use, control and oversee, but never before has the need for easily accessible data been so clear. The ability to access and use one’s data is not only vital for operational resilience, but now one of the most important drivers for a competitive advantage due to the importance of speedy decision-making.

As the financial landscape becomes even more complex and competitive, there are some key emerging trends that firms should be aware of.

1. Increasing Demand for Easily Accessible Data

The way people engage with data has been altered by the pandemic, including things like how to manage information barriers with staff working remotely. This is accelerating the shift of data to the cloud as people are expecting to be able to easily access data to do their jobs no matter where they are located.

Post-pandemic, some roles are likely to shift to being remote full-time, while other roles are more likely to combine office and home working. This means that employees will from now on need the ability to work with a range of data sets with the same ease that they would in the office. To enable this, many firms are focusing on collaboration (see point 4) and unifying their data in a single location. Recent advancements in data management make this possible, including intelligent solutions for consolidating and normalising both structured and unstructured data.

Post-pandemic, some roles are likely to shift to being remote full-time, while other roles are more likely to combine office and home working. This means that employees will from now on need the ability to work with a range of data sets with the same ease that they would in the office. To enable this, many firms are focusing on collaboration (see point 4) and unifying their data in a single location. Recent advancements in data management make this possible, including intelligent solutions for consolidating and normalising both structured and unstructured data.

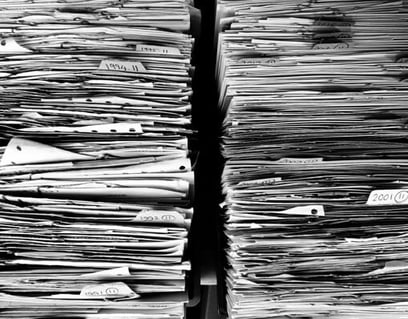

2. A Clear Focus on Data Governance

Regulators are making it clear that they want to see robust data governance programs at the firms they oversee. Many of the compliance challenge’s firms face today, such as transaction reporting errors and ineffective risk management controls, are deep-rooted in data quality issues. While this has been a long-standing issue, firms and the regulator alike are beginning to truly grasp the importance of good data governance. The regulator is becoming increasingly demanding on reporting quality, with a growing number of firms being approached by the UK FCA to address their reporting issues. Market participants are also coming around to the importance of data, recognising that poor-quality data will undermine any automation, artificial intelligence (AI) or machine learning (ML) project, no matter how sophisticated (see point 5).

The regulator is becoming increasingly demanding on reporting quality, with a growing number of firms being approached by the UK FCA to address their reporting issues.

3. Short-Term Data as a Source of Competitive Advantage

Good quality data is in many ways today considered a key element for a sustained competitive advantage. Firms are recognising that instant access to their short-term data and the ability to use that data quickly can facilitate rapid decision-making. Today, it is important that firms use both long-term and short-term predictions. Long-term predictions, which require a long history, are a continuing focus. However, in an increasingly competitive financial landscape, short-term analysis and decision-making is now crucial for firms to be able to respond to changing market structures, new opportunities, and threats.

|

SteelEye Data Platform

Advanced Record Keeping, eDiscovery, Trade Reconstruction and Analytics for Financial Services

LEARN MORE

|

4. Data Sharing across the Business

Collaboration has become a big theme during the pandemic. Current circumstances have resulted in much broader adoption of a whole range of collaboration-supporting tools, from Teams and Zoom to Slack and WhatsApp. This focus on collaboration supported by technology is changing the way organisations think about how they engage with colleagues across the business – not limited by location – and their data. Consequently, the discussions about increased data sharing in the finance industry have resurfaced.

Data is a significant challenge for firms to get right. Often, front, middle, and back-office teams work from different platforms and data sets that do not communicate. Driven by the desire to increase efficiencies and consistency by unifying this, there has been a newfound focus on establishing shared-data sets. There are many ways to achieve this, but compliance data has recently been flagged as potential source that could meet these requirements because the function already captures a lot of the information from across the business. And while compliance staff usually find this prospect scary, it does not need to be.

Data is a significant challenge for firms to get right. Often, front, middle, and back-office teams work from different platforms and data sets that do not communicate. Driven by the desire to increase efficiencies and consistency by unifying this, there has been a newfound focus on establishing shared-data sets. There are many ways to achieve this, but compliance data has recently been flagged as potential source that could meet these requirements because the function already captures a lot of the information from across the business. And while compliance staff usually find this prospect scary, it does not need to be.

With technological advancements, there are solid options available today that support secure permissioning and data audits to ensure control. We are already seeing such data-sharing occur, with many firms analysing the data collected for regulatory purposes to better understand other performance metrics across a broader range of activities, such as the instruments traded, the frequency of trading, and timing of executions by trader and counterparty. Such analysis can to reveal trends, identify areas of improvement and inform decisions around the allocation of resources.

5. Use of Data for Practical Problem-Solving

Over the past few years, there has been considerable excitement about the use of data in AI and ML projects to increase operational automation and efficiency across organisations. RegTech and FinTech start-ups have launched on the basis of blue-sky thinking about what is possible. However, many of the innovative applications of AI and ML fail to address the underlying data problems that persist in the industry. Given the period of performance pressure on financial services firms that is likely to emerge as a result of the pandemic, it is probable that firms will now shift their focus away from blue-sky thinking and refocus on solving immediate operational or regulatory compliance challenges – which needs to start with data.

Within many firms, the pandemic has accelerated pre-existing trends that were bringing to light the need for high-quality, accessible data that can be applied to practical use cases, to meet today’s challenges. Already, financial firms are recognising that there is potential competitive advantage in their data, and that good data governance can help break down silos. boost collaboration and improve efficiency across the organisation. The next year or two should be very exciting, indeed.

|

Insights

Next generation reporting solution revolutionising how you visualise, analyse and use your financial and regulatory data.

LEARN MORE

|

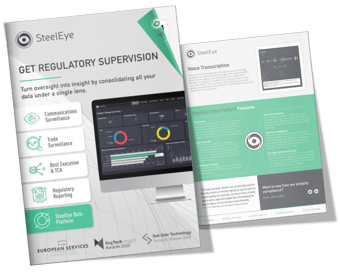

SteelEye is a trusted compliance platform for MiFID II, EMIR, Dodd-Frank, MAR, SMCR & more. Established to reduce the complexity and cost of financial compliance, SteelEye enables firms globally to manage their regulatory obligations through a single platform.

SteelEye’s ability to bring together, cleanse, index and analyse structured and unstructured data across all asset classes and communication types enables clients to effortlessly meet their regulatory needs, because when all this data is in one place, compliance becomes both easy and cost-effective. And with everything under one lens, firms also gain fresh insight into their business, helping them improve their efficiency and profitability.

To date, SteelEye has launched solutions for record keeping, trade reconstruction, transaction reporting, trade and communications surveillance, best execution reporting, transaction cost analysis and advanced analytics for regulations including MiFID II, EMIR, Dodd-Frank, SMCR and MAR.

.jpg)

Post-pandemic, some roles are likely to shift to being remote full-time, while other roles are more likely to combine office and home working. This means that employees will from now on need the ability to work with a range of data sets with the same ease that they would in the office. To enable this, many firms are focusing on collaboration (see point 4) and unifying their data in a single location. Recent advancements in data management make this possible, including intelligent solutions for consolidating and normalising both structured and unstructured data.

Post-pandemic, some roles are likely to shift to being remote full-time, while other roles are more likely to combine office and home working. This means that employees will from now on need the ability to work with a range of data sets with the same ease that they would in the office. To enable this, many firms are focusing on collaboration (see point 4) and unifying their data in a single location. Recent advancements in data management make this possible, including intelligent solutions for consolidating and normalising both structured and unstructured data.

Data is a significant challenge for firms to get right. Often, front, middle, and back-office teams work from different platforms and data sets that do not communicate. Driven by the desire to increase efficiencies and consistency by unifying this, there has been a newfound focus on establishing shared-data sets. There are many ways to achieve this, but compliance data has recently been flagged as potential source that could meet these requirements because the function already captures a lot of the information from across the business. And while compliance staff usually find this prospect scary, it does not need to be.

Data is a significant challenge for firms to get right. Often, front, middle, and back-office teams work from different platforms and data sets that do not communicate. Driven by the desire to increase efficiencies and consistency by unifying this, there has been a newfound focus on establishing shared-data sets. There are many ways to achieve this, but compliance data has recently been flagged as potential source that could meet these requirements because the function already captures a lot of the information from across the business. And while compliance staff usually find this prospect scary, it does not need to be.