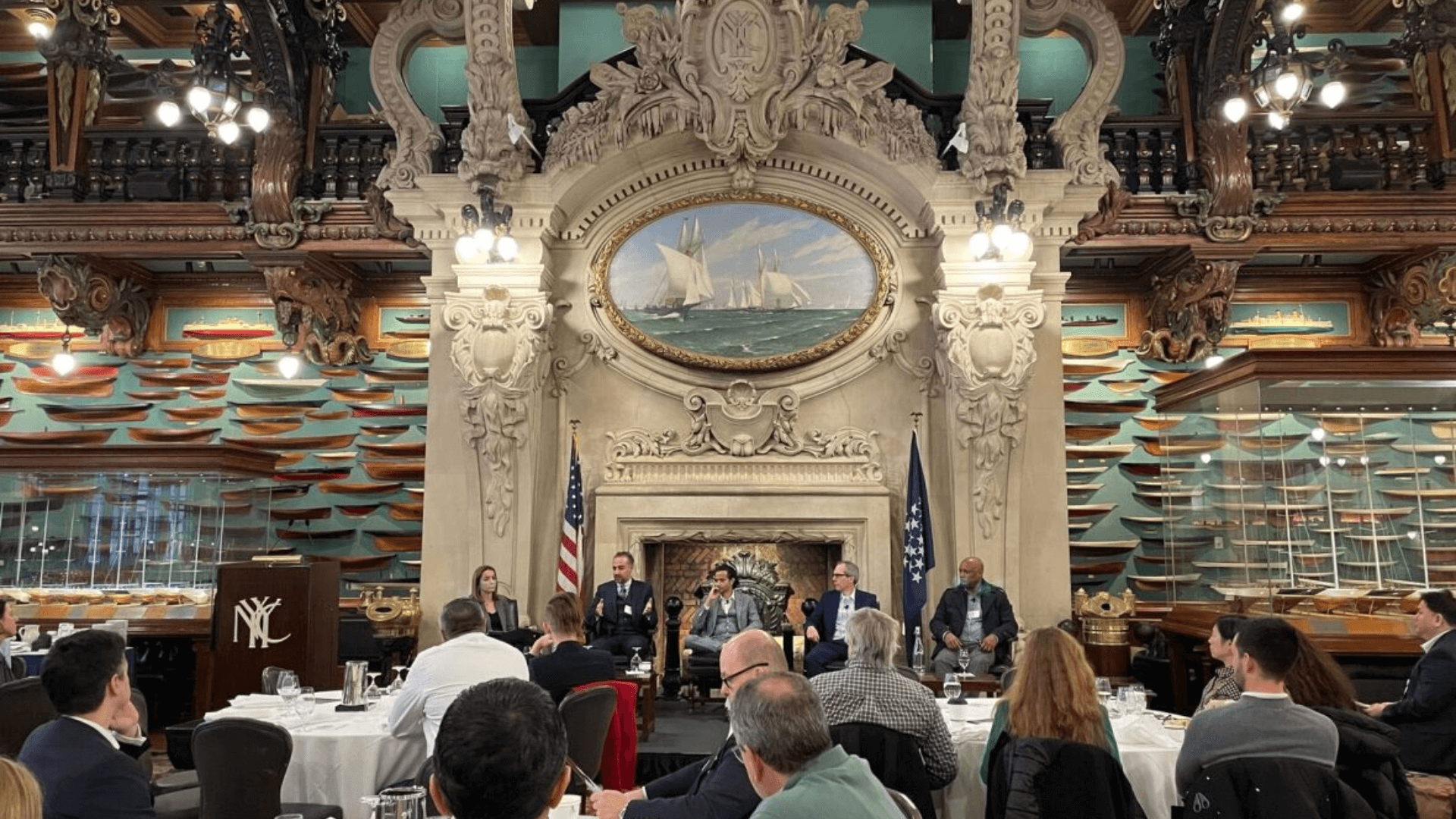

Last week, SteelEye hosted its first-ever Regs & Eggs New York. Taking place at the New York Yacht Club in Midtown Manhattan, the event kicked off with a fireside chat with AI thought leader Scott Amyx. To round out the morning, an expert-led panel then discussed some of the use cases, challenges, and opportunities that Artificial Intelligence (AI) and its subsets such as Machine Learning (ML) present to the surveillance space.

The panelists offered a unique blend of expertise and included Kelly Koscuiszka of Schulte Roth & Zabel LLP, Saifr’s Vall Herard, Prem Melville of Millennium Management, Deloitte’s Niv Bodor, and Sepehr Irandoost from Bank of America.

Since 2017, SteelEye’s Regs & Eggs London has annually hosted compliance practitioners for a morning of breakfast accompanied by industry experts sharing their insights and views on the latest regulatory topics. After another highly attended and well-received Regs & Eggs event this past May at the House of Parliament, the SteelEye team decided it was time to host its first Regs & Eggs gathering in North America. For many in attendance, it was their first introduction to SteelEye’s annual flagship event, which came just weeks after SteelEye celebrated its second anniversary in the Americas.

If you were at the event and are looking for a refresher of the sessions, or if you were unable to join us and want to know what you missed, this blog will cover some of the key takeaways from the first-ever Regs & Eggs New York.

A FIRESIDE CHAT WITH SCOTT AMYX

Scott Amyx is a deep-tech venture capitalist at Astor Perkins, where AI and its subsets like ML have long been on Scott’s radar as the future of tech. Before jumping into the pragmatic application of AI in the compliance space, Scott took a step back to unpack artificial intelligence as a whole and demystify some of the buzzwords, misconceptions, and seldomly discussed aspects of AI.

In a one-on-one fireside chat with SteelEye’s President of the Americas, Brian Lynch, Scott approached the conversation with an investor's view on the state of AI advancements, as well as the challenges and opportunities they presented. He offered the audience an alternative perspective, without focusing on specific financial services or regulatory use cases.

His first order of business was to cut through some of the hype and hyperbole that we have witnessed around generative AI in 2023. While the Artificial Intelligence phenomenon has swept the world in recent months and was even chosen as Collins’ Word of the Year, Scott was quick to point out that AI is not new and that there are many “cognitive technologies” that are well-established and being used in everyday life and offering significant benefits. These include Machine Vision, Natural Language Processing, and Speech Recognition, all underpinned by non-generative ML techniques that are well established. Scott also discussed some of the new models that are showing promise, including Liquid Neural Networks, which offer powerful ML capabilities with lower compute costs.

No discussion on AI would be complete without addressing the challenges and dangers that could come about, and Scott spent some time discussing the “double-edged sword” we are beginning to witness. AI offers fantastic opportunities and upside potential, but it can also be used maliciously by bad actors, which we are already starting to see. Firms that are early adopters should not ignore this and need to consider a strategy to protect themselves, particularly when it comes to understanding the provenance and integrity of the data that is so integral to the value of ML outcomes.

The conversation with Scott was both entertaining and educational, and it was a brilliant way to set the audience up for the panel discussion, where the participants would delve into topics such as the practical application of AI, as well as regulatory challenges faced by financial services firms today.

The Role of AI in Market Surveillance

Having explored the world of AI from the perspective of an investor and thought leader, the role of the panel was to focus on the pragmatic application of AI tools and technologies to current and future regulatory challenges. Kelly Koscuiszka moderated the discussion and approached the challenge as a regulatory expert who deals directly with clients undergoing SEC examinations and has a first-hand perspective on the rules being proposed and enacted by the SEC.

The panel was made up of experts from all corners of the challenge, including:

-

Vall Herard, previously a Risk Manager, is now CEO of Saifr, which is a vendor founded by FidelityLabs. Saifr is known for delivering practical solutions. They do so by utilizing some of the most innovative ML techniques, helping investment firms identify market-facing content that might breach regulatory restrictions related to marketing content and public statements. During the panel discussion, Vall highlighted the fact that the strength of any ML solution lies in the quality of the data that trains the models. Saifr knows this firsthand, as they benefit from having access to high-quality, curated data from Fidelity.

-

Niv Bodor of Deloitte offered a consultant’s perspective. Niv has been involved in the review of the regulator’s use of ML to improve and accelerate examinations. When asked what we can learn from the regulator's application of ML, he was quick to point out that regulators have a different perspective than those in the audience. Market participants that are already leveraging ML are doing so to meet specific rules prescribed by the regulator. However, regulators can take a broader analytical approach when using ML and can explore any aspects of the data they receive to look for signals of fraud or market manipulation.

-

Prem Melville, an AI expert and tech entrepreneur, spoke about the considerations that need to be accounted for when it comes to implementing AI solutions within a financial services firm. One that stuck out, in particular, was the question around “conversations” with generative AI services and whether they should potentially be considered a form of eCommunications, which would then subject them to record keeping and supervision. The idea was an intriguing one, and given the recent increased emphasis by North American regulators around record keeping failures, it may be a topic that compliance teams need to address sooner rather than later.

-

Sepehr Irandoost, the current Global Head of Surveillance Efficiency and Effectiveness at Bank of America, has a long and storied history in trade surveillance. During the session, Sepehr discussed the challenges presented by current trade surveillance requirements, which included two in particular that resonated with the audience. The first challenge was around leveraging ML to identify known patterns of manipulation, such as spoofing and wash trading. The second dealt with the complementary activity of auto-reviewing and prioritizing the alerts that are created by surveillance watches.

The expert-led panel offered a rich set of perspectives, thanks in large part to their diversity of expertise and experiences. Not only were the participants willing to share their knowledge and experiences, but they also built on the ideas and questions posed by their fellow panelists, making for an insightful and compelling session.

The Future of AI

While the fireside chat and panel leveraged experts from different backgrounds who were tasked with speaking on separate AI-related topics, there were additional themes that found their way into both sessions. Both Scott and the panel were quick to remind us that while AI and its subsets like ML are extremely powerful tools that can impact and enhance nearly every aspect of our lives, we must still proceed with caution as we work to make the “unknown” into the “known” and learn their true powers and capabilities.

Generative AI tools such as ChatGPT have been around for less than a year. And while we will undoubtedly see AI used for good and to advance every industry from financial services to pharmaceuticals to sports performance, we must also be cautious of the negatives that can and will come about with these advancements. There will always be rogue actors that use AI, as they have with every other emerging technology, to advance their own interests and do more harm than good.

Additionally, the makeup of AI looks very different today than it did five years ago, and what we are witnessing in the current moment will almost certainly look very different to the landscape another five years from now. With that in mind, it is all the more reason to invest in learning and understanding the technology and leverage it as an aid rather than a replacement for any of the functions we as humans are currently using it for.

Whether it be in the form of SteelEye’s Compliance CoPilot or generative AI tools used to help write the perfect greeting card, one thing is for certain: AI is here to stay.

At the core of Regs & Eggs, SteelEye has always strived to make the event informative and ensure it adds value for each of its attendees. While we have come to greatly enjoy annually hosting and catching up with our clients, partners, friends, and new connections, a successful Regs & Eggs is one where everyone in the room leaves feeling like they have gained a better understanding of the compliance landscape and where it may be headed next. We want to thank all our North American attendees who participated in our first-ever Regs & Eggs New York, and we look forward to seeing you all again next year!

How SteelEye Can Help

Fittingly, Regs & Eggs New York took place shortly after SteelEye announced its latest product release: Compliance CoPilot. Compliance CoPilot is an AI-driven tool that uses the capabilities of advanced Large Language Models (LLMs) to greatly accelerate the Communication Surveillance Alert Review process. The product aims to add value for compliance practitioners, as it can analyze vast amounts of communications data more efficiently than humans can while also recommending follow-up actions.

By automating more aspects of compliance, this new end-to-end, AI-enabled assistant can result in significant cost savings through boosted analyst efficiency, as well as the overall scalability of the compliance function. However, even with these benefits clearly spelled out, SteelEye is conscious of the fact that the stakes are extremely high for compliance officers, and oversights in their work can cause irreparable damage. That is why the Compliance CoPilot was created to serve as an intelligent assistant that can seamlessly integrate into processes, rather than a substitute for trained professionals. Human oversight cannot be replaced and remains central when leveraging CoPilot, and this is a recommendation that we believe should be considered any time AI is used in any shape or form.

Turn Supervision into Super Vision

Contact our compliance experts to see our platform in action or learn more about how we can help your firm reduce compliance fatigue.

SPEAK WITH US TODAY