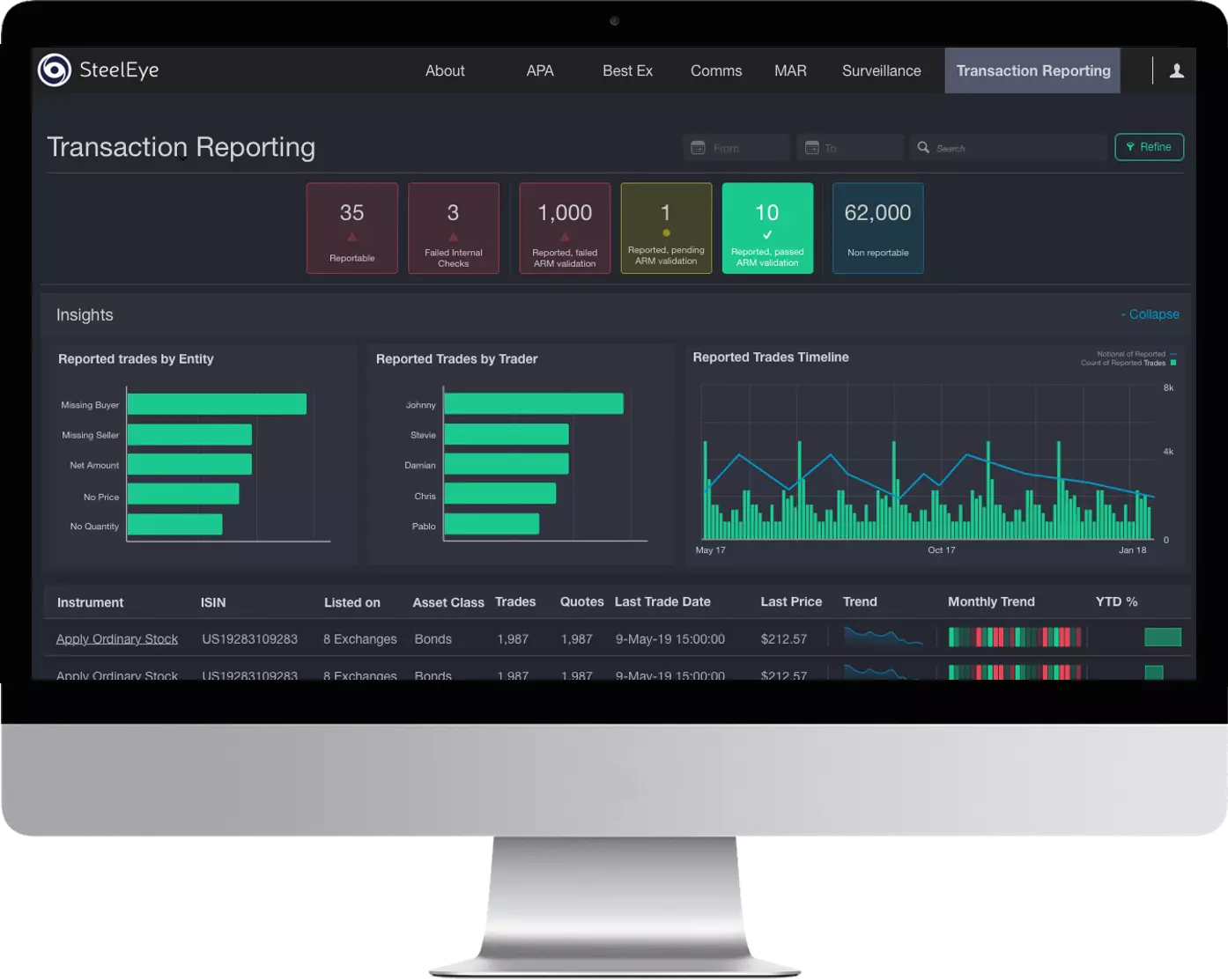

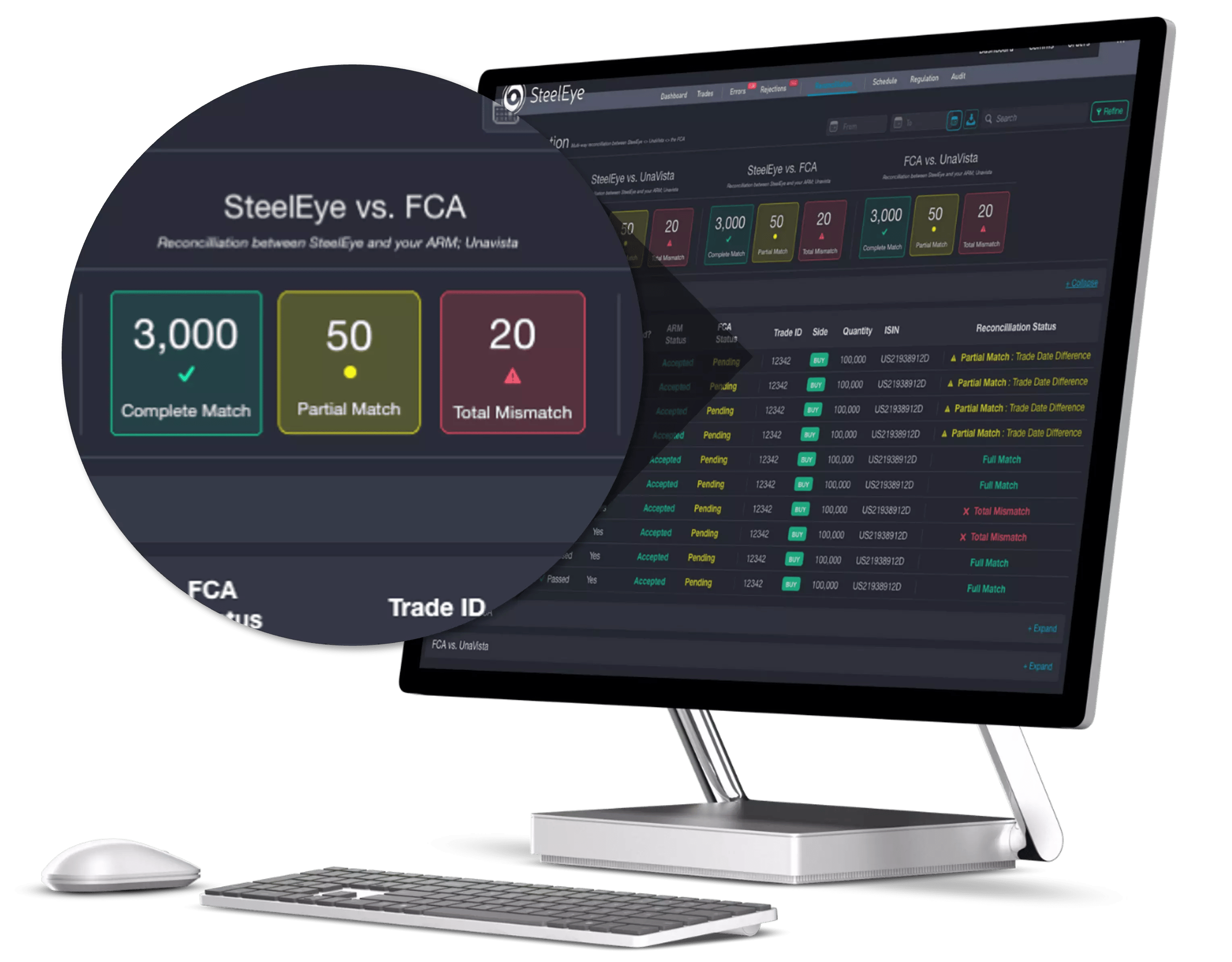

Take Control of your Regulatory Reporting

Transaction reporting is every firm’s obligation under MiFID II and requires you to compile and report vast amounts of data. However, with up to 65 different data fields and over 300 validation criteria, this can end up consuming significant time and budget.

.png?width=180&height=66&name=Risk%20Awards%202021%20SteelEye%20(3).png)

.webp?width=180&height=60&name=Best%20buy%20side%20market%20surveillance%20tool%20platform%20(2).webp)