Markets, financial instruments, trading methods, and communication channels have all been evolving at an increasingly rapid pace over the past decade, as has the regulatory burden for detecting and preventing fraudulent behavior and market manipulation.

Yet, working in or leading a surveillance team is no small undertaking and can be stressful and underappreciated. There are endless priorities but not nearly enough resources or time to get them all done. As a result, surveillance leaders must make difficult decisions about what risks to focus on. However, if they get it wrong, the consequences are grave and can lead to disabling fines, reputational damage, and operational sanctions.

To meet regulatory expectations, compliance teams must ensure they catch all key risks, which can be easier said than done. Unaligned trade and communications surveillance platforms have resulted in inefficient workflows, manual processes, and a proliferation of data and systems – often leading to missed risks, high numbers of false positives, and a lack of holistic oversight. A new approach is needed to ensure that risks are identified and managed efficiently.

In this blog, we look at the challenges of unaligned trade and communications surveillance platforms and why the industry needs to change its approach to supervision- moving towards an integrated surveillance model.

Topics Covered:

What is integrated surveillance?

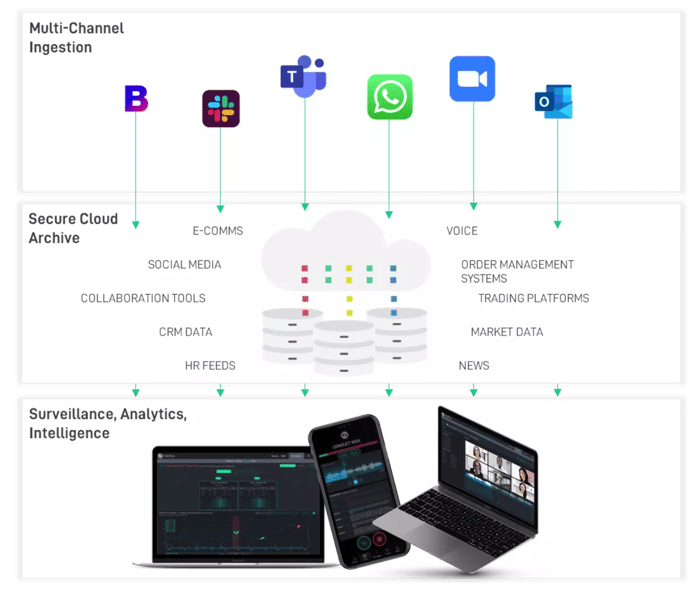

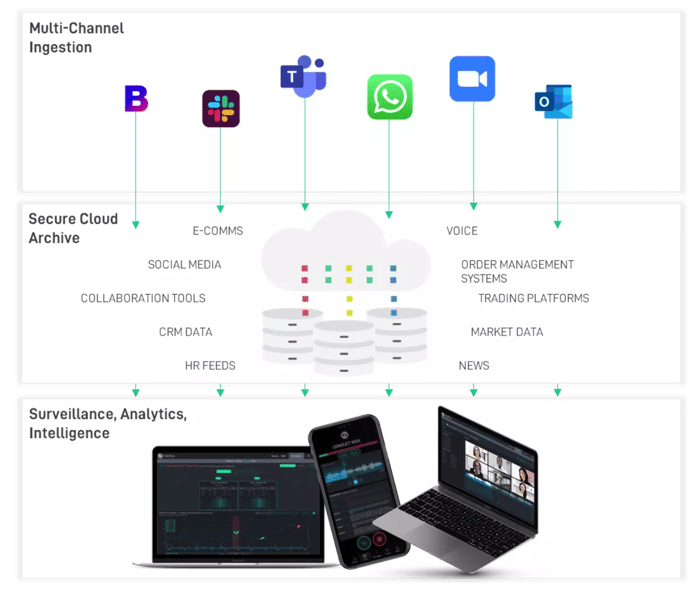

Before delving into the topic, let’s first define what we mean by integrated surveillance. Integrated surveillance involves bringing together a multitude of signals across different surveillance disciplines in a single data source to monitor for market manipulation, conduct breaches, leakage of material non-public information (MNPI), and investigate potential issues with as complete a data ‘picture’ as possible.

In addition to surveillance alerts, an integrated surveillance solution enables you to harness related contextual data to speed up reviews and deal with false positives.

When an alert is triggered, surveillance teams can quickly and easily bring together orders, trades, communications, market data, and news into a single case for investigation, which can be escalated, reported, or resolved with ease.

Data and systems proliferation leading to inconsistent processes and missed risks

Regulatory rules in all major economies require financial services firms to store and monitor the communications activity of regulated employees and trading activity. These rules exist to protect the financial markets and prevent illegal activity. For example, trade surveillance rules require firms to monitor trading activity for intentional or unintentional market manipulation, such as insider trading, spoofing, wash trading, and front running. Communications surveillance rules exist for similar reasons - to spot instances of insider trading, leakage of MNPI, collusion, and more.

However, meeting these rules can be a massive undertaking for financial firms. Monitoring the wide variety and high volume of communications across ever-expanding collaboration channels is complex and costly. At the same time, increasing trade surveillance regulations and regulatory scrutiny has added significant operational overhead and risk.

Compounding these challenges is the fact that communications and trade surveillance systems aren’t aligned, which has created awkward workflows and highly inefficient processes.

In fact, today, most firms support a range of trade and communications surveillance technology across teams and geographies. Firms often also have different tools for the various types of surveillance they support, including trades, orders, voice, email, chat, news, and social media. Some firms have up to 10-15 different systems. This generates a patchwork of data that is usually managed and investigated by siloed teams separated by geography, specialty, and so on.

Challenges associated with unaligned trade and communications surveillance

Inefficient and manual processes

With siloed platforms and teams for surveillance, firms’ operational models have become inefficient and manual. For example, when an alert is flagged, it can take an extended period for surveillance analysts to get to and analyze the risk, as they have to search across multiple systems to get the answers they need. They then need to manually tie the data together from those different platforms to form a complete picture for their investigation. To add fuel to the fire, different surveillance processes are often managed by different teams, which means investigations can be highly disruptive. Because there is limited cross-platform and cross-data insights when different surveillance systems are managed by different teams, there is limited contextual information available for the systems to reduce false positives – resulting in many teams being overloaded with false alerts.

All of this is a hindrance to meeting regulatory deadlines and conducting timely investigations. As a result, firms have ended up in a situation where their only option is to support large teams of surveillance analysts that sift through alerts with long work queues.

Missed risks

The operational challenges that stem from having separate or multiple trade and communications surveillance software tools create inconsistent processes. For example, different teams might have different data management and risk prevention processes. Without a standardized process, collaboration across teams becomes harder. It can result in missed risks due to a lack of holistic oversight. For instance, someone participating in mildly suspicious behavior across both communication and trade surveillance should probably be investigated. However, when siloed, these risks are often not recognized, and ultimately, analysts cannot see that 1+1 can sometimes equal 3.

Lack of oversight and control

Supporting separate platforms for several types of surveillance results in siloed data. When data is stored across many systems and inconsistent processes are used across teams, it is prohibitively difficult to evidence what is happening within the organization through data and reporting. As a result, it is hard for surveillance leaders to know that compliance is getting done right and have a sense of assurance in their compliance processes and procedures.

Challenges onboarding new tools and channels

Today, the trading and communications landscape is evolving rapidly, and the front office often moves faster than the back office can respond to. For example, front office trading in new instruments or asset classes needs to be covered in back office risk programs, as does the use of newer communications channels like WhatsApp. However, it can be hard for firms with unaligned trade and communications surveillance systems to onboard new tools and channels. This is because when a platform is built around consuming and analyzing only one type of data, it is often not flexible or customizable, meaning that it is not possible to bring in other data sources.

This is why many firms have ended up with different trade surveillance systems for different asset classes and communications surveillance systems and processes for different communications channels. The cumulative effects can be grave. An inability to respond flexibly to front office needs or emerging risks can compromise compliance and restrict a firm’s competitive edge.

Contextualizing the issue through a real-world example

While integrated surveillance is a relatively new approach, there are plenty of real-world instances in recent years where it could have made a difference and benefited financial firms.

For instance, in 2011, a scandal involving a rogue trader at a large international investment bank resulted in a loss of $2 billion due to unauthorized trading activities. The bad actor, working in London as a director of a global synthetic equities trading team, conducted a series of unauthorized trades that resulted in significant losses for the bank.

At the time, the individuals receiving and investigating trading alerts within the firm differed from those receiving and investigating communications alerts. It is unlikely that the individual looking at the potential trading data generated by the rogue trader’s activities had immediate access to the communications information. Ultimately, this meant there would be no visibility of the trader’s "robust" language with the operations team.

After trying to cover up the losses, the guilty individual eventually confessed to his actions and turned himself into the police. He was subsequently charged with two counts of fraud and two counts of false accounting and was sentenced to seven years in prison.

However, it is possible that if the bank’s market manipulation team had been able to merge trading data with communications data, these combined signals could have potentially enabled them to investigate the rogue trader before his criminal actions combusted into a massive loss.

Why integrated surveillance is needed

Integrated surveillance enables firms to take a much more strategic approach to meeting their regulatory and ethical obligations to fight market manipulation. By having one platform across the enterprise that can monitor trades, orders, voice, email, chat, social media, and more, firms can easily bring the necessary data together to develop a much clearer picture of the activities that an individual is engaging in.

It also creates a single lens and source of data across multiple trading platforms, order management systems, and communications channels to detect bad actors - with instant retrieval and analysis. This provides additional context for instances where one piece of activity on its own might not be suspicious but, if linked to something else, could alert surveillance teams that something is worth investigating.

Ultimately, this can reduce not only false positives but false negatives, speed up investigations, and deliver better outcomes for the firm and its stakeholders.

The growing complexity and sophistication – and regulation – of market manipulation now demand a data-led approach.

The way in which most financial firms manage their trade and communications surveillance obligations will not be adequate for much longer. Antiquated and unaligned systems result in too many missed risks, inefficient processes, and high rates of false positives. This isn't going to go away until the approach is changed.

Integrated surveillance presents a scalable and futureproofed solution. With an integrated surveillance approach, data can be unified, processes automated, and investigations can be managed in one place with consistent workflows across geographies, specialties, and teams.

This is the first blog of our integrated surveillance series. The following blog will debunk some of the most common misconceptions around integrated trade and communications surveillance. Stay tuned and follow us on LinkedIn for updates about when the blog will be released.

How SteelEye can help

SteelEye is the first and only truly integrated trade and communications surveillance solution. SteelEye gives compliance and surveillance teams full assurance and peace of mind that risks are identified and actioned efficiently.

SteelEye’s modern data architecture makes it easy to combine data from any channel into a single, compliant, and secure repository. Today, SteelEye is the only solution that can natively bring together trades, orders, communications, global news, and market data on a single platform.

The platform has established connectivity to over 50 trade and order data handlers and 85 voice, social, video, and collaboration tools. The platform’s powerful analytics tools deliver intelligence that makes proactive oversight an efficient and effective reality.

SteelEye supports integrated trade and communications surveillance, giving firms an all-encompassing solution that lets them unlock actionable insights to sharpen their competitive edge.

Features:

- Dynamic, intuitive dashboard transforms comms, trade, and market data into rich information that fosters action

- Powerful language-based search engine facilitates granular reporting

- Configurable, automated pattern matching, behavioral signals, and other alerts spotlight early warning signs of abuse

- Machine learning and real-time backtesting reduce false positives

To see our platform in action, or to learn more about how we can help your firm gain a competitive advantage, contact our team of compliance experts now.

Turn Supervision into Super Vision

SPEAK WITH US TODAY