The FCA has published its 69th Market Watch Newsletter, discussing firms’ arrangements for market abuse surveillance - drawing on their observations from engaging with small and medium-sized firms.

FCA's Market Watch 69 highlights the regulator's concerns over firms' ability to meet their obligations under the UK Market Abuse Regulation ('UK MAR'), particularly for small and medium-sized firms.

The newsletter highlights that certain firms are less effective at identifying the market abuse risks they are exposed to - making it clear that effective surveillance isn't just a requirement for tier 1's but for "all firms subject to surveillance requirements under Article 16(2) of UK MAR."

As a reminder, UK MAR requires firms to identify and report instances of potential market abuse and have in place effective arrangements, systems and procedures for surveillance. These measures should be appropriate and proportionate to the scale, size and nature of the firm's business activities.

It is worth noting that many firms have struggled to implement effective surveillance procedures for a number of reasons which you can read about in our recent blog "Why firms need to enhance their UK MAR compliance" written together with GRSS.

Highlights from FCA Market Watch 69:

The need for regular market abuse risk assessments

FCA's Market Watch 69 highlights the requirement for firms to carry out regular market abuse risk assessments to ensure effective surveillance coverage. In the newsletter, the FCA emphasises that effective assessments involve a consideration of the different types of market abuse behaviours that are prominent today and how they apply across different areas of the business and asset classes. Read about what Effective Surveillance can look like in our blog "Effective Surveillance - Meeting your MAR obligations."

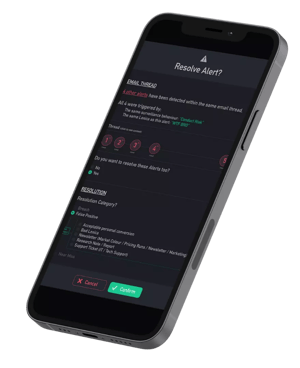

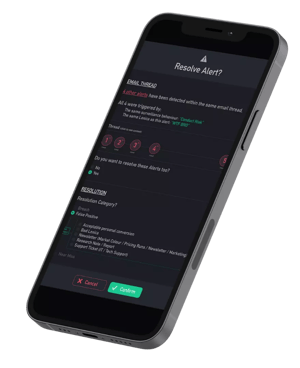

How SteelEye helps: SteelEye offers a range of highly customisable market abuse behaviors and alerts including wash trading, spoofing, frontrunning, layering and much more.

The importance of calibrated alerts

Market Watch 69 also looks at the importance of considering the different characteristics of asset classes and instruments before applying this information to the calibration of alert scenarios. The regulator wants to see that firms have implemented a surveillance system that is customised to their specific business activities. There is no one-size-fits-all solution when it comes to MAR compliance.

"If a firm uses a common threshold in its alert scenarios for all instruments, it may struggle to ensure effective monitoring (the threshold is set too high/too low for some instruments), or it may generate a high amount of ‘noise’ (the alert is calibrated to the most sensitive of the instruments)."

- FCA Market Watch Newsletter 69

How SteelEye helps: SteelEye offers multiple thresholds and calibrations specific to the markets being surveyed, giving firms the tools to implement a highly tailored surveillance program.

The advancements within third-party systems

According to the FCA, third-party system functionality has progressed in recent years in areas such as tailored calibration. However, sometimes firms are unaware of these developments and may not be making the best use of the technology.

How SteelEye helps: SteelEye has made several enhancements to its platform over the last 12 months. These include enhanced use of context within the surveillance solution to speed up investigations and a new order book or market replay solution to facilitate more precise and rigorous market abuse surveillance.

Reporting all instances of suspected abuse, not just if a clear link is found

The FCA also highlights its concerns surrounding firms with weaknesses in their review and escalation processes where no clear link to market abuse was found. In many cases, this will be due to resource constraints and the challenges presented by siloed platform when firms try to bring data together to carry out an investigation.

"We have seen some firms with weaknesses in their review of surveillance exception alerts. For example, only escalating and considering reporting where they identify an obvious link between the client and the issuer or source of the inside information. While the existence of such a link may be an aggravating factor in assessing whether reasonable suspicion of market abuse has been reached, its absence does not necessarily serve as sufficient mitigation to close alerts."

- FCA Market Watch Newsletter 69

How SteelEye helps: SteelEye provides advanced case management tools which enables firms to automatically bring together all the context sounding a trade or order, or a series of trades and overs over a specific time period, including commutations, marker data, news, social media feeds and more. This makes it easy for firms to investigate, escalate, export and report suspected instances of market abuse even where no clear link was found.

READ FCA'S MARKET WATCH 69

About SteelEye:

SteelEye’s RegTech solution helps firms reduce the complexity and cost of compliance through a suite of holistic capabilities, including monitoring and surveillance tools that help firms identify and mitigate insider trading and market abuse. With advanced data analytics and trade and communications oversight underpinned by sophisticated algorithms.

SteelEye's platform helps identify early warning signs of misconduct whilst reducing false positives making for a stronger risk assessment. The granularity of trade detail the SteelEye solutions provide not only helps compliance officers proactively identify situations that may be questioned by regulators, but actively empower firms overall to manage loss avoidance and insider trading before any misconduct can occur.

With SteelEye, firms can:

-

Bring trade and order data together on a single platform, complemented by market data, news and social media insights

-

Strengthen risk detection through intelligent surveillance

-

Improve trade activity and behavior oversight

-

Consistently demonstrate compliance

-

Free up resources and save costs

FCA Market Watch 68-Market conduct & transaction reporting issues

The FCA's 68th Market Watch Newsletter looks at monitoring gaps in fixed income and rates markets.

FCA Market Watch 66-Market conduct and transaction reporting issues

The FCA's 66th Market Watch Newsletter looks at market conduct and transaction reporting issues.