London, 26 April 2021: SteelEye, the compliance technology and data analytics firm, has completely revolutionised market abuse and communications monitoring with its innovative new lexicon technology.

London, 26 April 2021: SteelEye, the compliance technology and data analytics firm, has completely revolutionised market abuse and communications monitoring with its innovative new lexicon technology.

-

Tightening regulations and growing volumes of communications channels has created a challenging operational landscape for compliance teams

-

SteelEye’s new Surveillance Lexicon monitors more than six times as many search terms than a standard lexicon for an unrivalled level of oversight, helping firms better identify signs of financial crime and market abuse

-

Artificial Intelligence and context reading technology reduces inaccurate results (false positives)

-

Lexicon supports compliance teams in meeting regulations designed to protect the integrity of the financial markets

For many years, financial services firms have relied on the surveillance lexicon - a piece of technology that scans staff communications for specific words and sequences of words that could suggest market abuse or misconduct.

While a vital compliance tool, it has a limited search capacity and is unable to filter out irrelevant matches, meaning it is likely to generate high numbers of false positives – increasing the risk of firms missing key signs of market abuse.

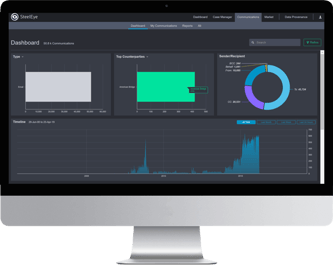

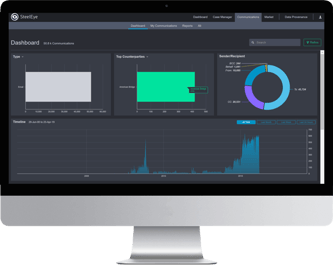

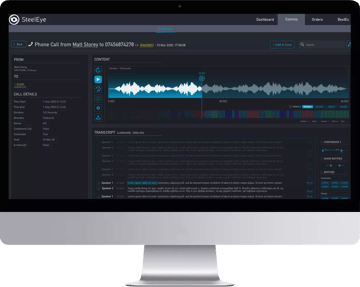

SteelEye’s new system, which lives within the communications monitoring suite, provides a solution to these issues – offering an unparalleled number of search terms while refining results based on relevance through artificial intelligence (AI).

|

SteelEye's eComms Surveillance enables you to effortlessly capture, manage and control all your communications from a wide range of channels

|

SteelEye’s Surveillance Lexicon covers tens of thousands of search-terms and captures all linguistic word-variations, colloquialisms, as well as ‘text-speak’ and other abbreviations, shortenings and even typos.

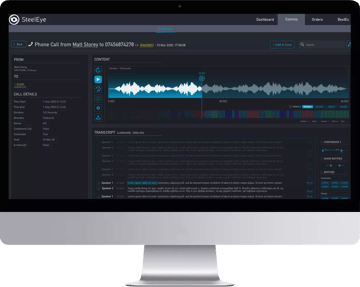

It also uses AI to filter for context and remove false positives. For example, it can differentiate between a sentence located in the subject, body or signature of an email and identify if someone writing “let’s split the difference” is talking about a trade or the lunch bill, flagging only the former as cause for concern.

One of the major risk areas for financial firms is the growing number of alternative communications channels they are unable to monitor, because, despite putting policies in place that ban the use of for example WhatsApp, traders are still able to communicate illicitly on this channel.

One of the major risk areas for financial firms is the growing number of alternative communications channels they are unable to monitor, because, despite putting policies in place that ban the use of for example WhatsApp, traders are still able to communicate illicitly on this channel.

SteelEye’s Lexicon meets this challenge by flagging the intent to have an illicit conversation on an unmonitored channel. For example, ‘Let’s talk on WhatsApp’ or ‘I’ll text you’ is flagged, whereas many legacy lexicons do not include the word ‘WhatsApp’ or have the ability to recognise ‘I’ll’ as opposed to ‘I will’.

The increased number of search terms combined with the context-driven technology enables firms to cast their surveillance monitoring net as wide as possible without being overloaded with results, ensuring firms can spend more time on investigations and escalations instead of sifting through false positives.

Matt Storey, Chief Product Officer at SteelEye said:

“One of the main reasons legacy lexicons trigger such vast volumes of false positives is because they don’t consider the context in which a communication takes place.”

“As a result, many firms have ended up limiting themselves to a small number of search terms to reduce the number of alerts triggered. However, in doing so, they risk missing key signs of market abuse.”

“Our new surveillance lexicon completely solves this problem by not only accounting for an unparalleled degree of linguistic variety – but also introducing AI to determine the context of how and where a piece of communication took place.”

“These two fundamental changes enable firms to monitor for a much wider range of risks and greatly reduce the number of false positives.”

As the way firms and their employees operate continues to evolve, it is imperative they focus on the underlying reason for why being tech-enabled is essential: to protect the integrity of financial markets. This technology and the way its utilised supports compliance teams and provides peace of mind to senior managers, while also ensuring that market abusers are brought to justice.

In the future, SteelEye hopes to develop the lexicon even further by connecting additional elements. For example, if an employee typically has phone conversations of more than two minutes and then has a 10 second call, with uncharacteristic intonation – where he simply says, “check WhatsApp”, the technology would be able to combine the reference to an unmonitored channel with the unusual call duration to create a more accurate picture of what is going on.

Matt concludes: “Lexicons are and will remain important to help firms detect signs of wrongdoing. The industry must focus on getting them right by thinking about searching for language, meaning, and intent rather than individual words or phrases.”

For further information, please contact:

Emmy Granström

Marketing Director – SteelEye

emmy.granstrom@steel-eye.com

+44 (0)203 821 6039

For media enquiries, please contact:

Marius Putnam, Communications Executive

marius.putnam@boldspace.com

+44 78074 82181

About SteelEye:

At SteelEye, we transform compliance through data innovation – making data that otherwise wouldn’t work together, work. This enables financial firms to effortlessly and accurately comply with a range of regulatory obligations, and ensures regulators have the data they need to effectively maintain the stability of the financial markets.

|

Let us show you how we simplify compliance

We’ll give you a tour of our platform, so you can see how data-driven compliance drives better results.

|

One of the major risk areas for financial firms is the growing number of alternative communications channels they are unable to monitor, because, despite putting policies in place that ban the use of for example WhatsApp, traders are still able to communicate illicitly on this channel.

One of the major risk areas for financial firms is the growing number of alternative communications channels they are unable to monitor, because, despite putting policies in place that ban the use of for example WhatsApp, traders are still able to communicate illicitly on this channel.